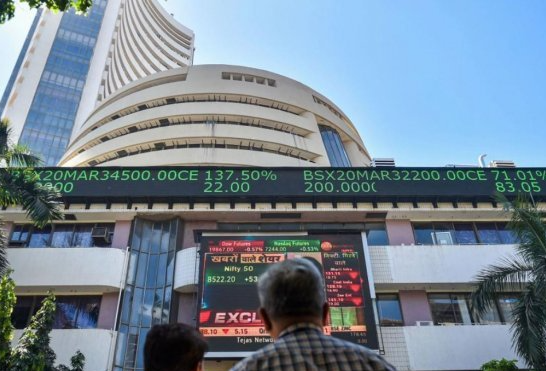

Mumbai, July 12: The upward momentum continued for the third consecutive day in benchmark equity indices on Wednesday, fueled by consistent foreign fund inflows and strong buying activity in Reliance Industries. The rally in US markets on Tuesday also played a role in sustaining the winning streak.

In the early trading session, the 30-share BSE Sensex surged by 193.8 points to reach 65,811.64, while the NSE Nifty climbed by 68.3 points to 19,507.70.

Several prominent companies contributed to the gains in the Sensex pack, including Reliance Industries, Titan, Bajaj Finance, Kotak Mahindra Bank, NTPC, ITC, and State Bank of India. However, there were a few laggards, such as IndusInd Bank, Mahindra & Mahindra, UltraTech Cement, HCL Technologies, Infosys, and Asian Paints.

Exchange data revealed that Foreign Institutional Investors (FIIs) continued their buying spree, with equity purchases worth Rs 1,197.38 crore on Tuesday.

In Asian markets, Seoul and Hong Kong traded in positive territory, while Tokyo and Shanghai witnessed a decline. The US markets closed on a positive note on Tuesday.

The early trade on Wednesday indicated the possibility of steady gains in the market, propelled by the strong surge in the US markets overnight. With Asian indices also showing robust gains, local markets may further advance, despite concerns of an overbought market.

Investors will keep an eye on the inflation figures set to be announced later in the day, while the first-quarter results of IT majors TCS and HCL Tech will provide insights into the global IT sourcing scenario and its outlook, as stated by Prashanth Tapse, Senior VP (Research) at Mehta Equities Ltd.

Global oil benchmark Brent crude recorded a 0.18% increase, reaching USD 79.54 per barrel.

On Tuesday, the BSE benchmark rose by 273.67 points or 0.42% to settle at 65,617.84, while the Nifty climbed 83.50 points or 0.43% to close at 19,439.40.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, expressed optimism, stating, “Even after the recent market surge, sentiments remain clearly bullish. Both global and domestic cues are positive. If the US CPI data, expected to be released later today, indicates a year-on-year inflation dip below 3%, it will trigger a further rally in the US market, subsequently boosting other markets as well.”